|

Click here for a downloadable version of the Network's State Policy Priorities.

STATE LAME DUCK LEGISLATIVE PRIORITIES

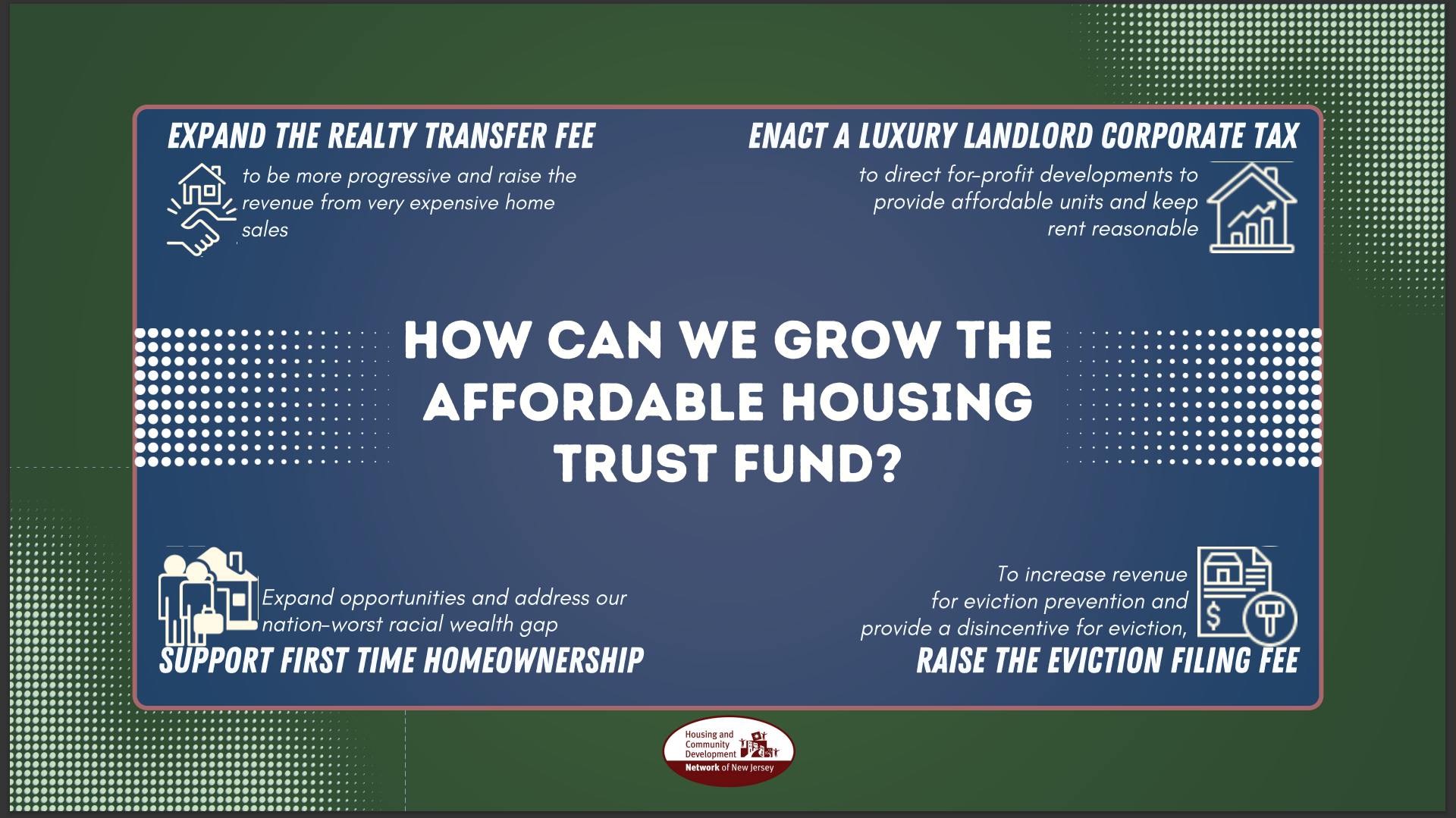

- S4728/A5963 - Build Back the Affordable Housing Trust Fund (Wimberly/Reynolds-Jackson/Murphy)

- S2346/A2258 - Code Red (Turner/McKnight/Lopez/McCoy)

- S4470/A5702 - Community Wealth Preservation Program Update (Timberlake/Speight)

- S1083/A1678 - Homelessness Bill of Rights (Timberlake/Atkins)

- S268/A3282 - Raising the Eviction Filing Fees (Stack/Lopez/Rodriguez)

- S2347/A2792 - Accessory Dwelling Units (Singleton/Timberlake/Greenwald/Lopez)

- S3659/A4899 - Rental Property Application Fees (Stack/Carter)

- S4832/A3360 - Municipal Homeless Trust Funds (Scutari/Carter)

- S4280/A5432 - Unconscionable Rent Increases (Burzichelli/Lopez/Miller)

- S3672/A4987 - Immigrant Trust Act (Johnson/Park)

Updated November 2025

FEDERAL POLICY PRIORITIES

- Expand rental assistance to additional extremely low-income households, including those experiencing and at risk of homelessness.

- Increase the National Housing Trust Fund to build affordable, safe homes for households with the greatest needs.

- Repair and preserve public housing, which is home to 2.5 million residents across the country. Public housing is critical to ensuring people with the greatest needs have a safe, decent, affordable, and accessible place to call home, and the preservation of this community asset must be included in any strategy to ensure housing is a human right.

- The Network, its members, and its coalition, solidified NJ's Fourth Round Affordable Housing Obligations under the state's landmark Mount Laurel decision by successful advocacy of A4/S50. This legislation, which formally abolishes the state's outdated Council on Affordable Housing, outlines many ways towns can achieve their fair share obligations through preservation, upzoning, rehabilitation, inclusionary zoning, and more. The Network will work closely with our CDC and nonprofit builder members seeking to be part of approved municipal fair share plans.

-

Eligibility window for emergency assistance doubled from 60 months to 120 months

-

Community Wealth Preservation Program, which allows individuals and CDCs to access properties at sheriff's sale to generate wealth and promote affordable homes, was signed into law

-

Interagency Council on Homelessness was established under the Office of the Governor

-

Continued funding to the Affordable Housing Trust Fund with no diversions to address the state's 250,000 shortage of affordable homes

-

$80 million allocated to NJHMFA’s Affordable Housing Rehabilitation and Renovation Program

-

$30 million allocated to first generation homebuyers and the Resilient Home Construction Pilot Program

-

$115 million allocated to the Affordable Housing Production Fund established last year through NJHMFA to help fulfill municipal housing obligations.

|

|

|